OR-CAPITAL SA

At OR Capital SA, we help asset managers, fiduciaries, and family offices design smarter portfolios using clear, rule-based tools.

Our solutions turn complex strategies into structured, transparent models. So, our clients can make confident, data-driven decisions in dynamic markets.

OR-CAPITAL

At OR Capital, we help asset managers, fiduciaries, and family offices design smarter portfolios using clear, rule-based tools.

Our solutions turn complex strategies into structured, transparent models. So, our clients can make confident, data-driven decisions in dynamic markets.

OR-CAPITAL

At OR Capital, we help asset managers, fiduciaries, and family offices design smarter portfolios using clear, rule-based tools.

Our solutions turn complex strategies into structured, transparent models. So, our clients can make confident, data-driven decisions in dynamic markets.

Our products

We developed complex Risk Management Models for Financial Institutions and Asset Management firms

Adaptive Investment

Portfolio Optimization Module

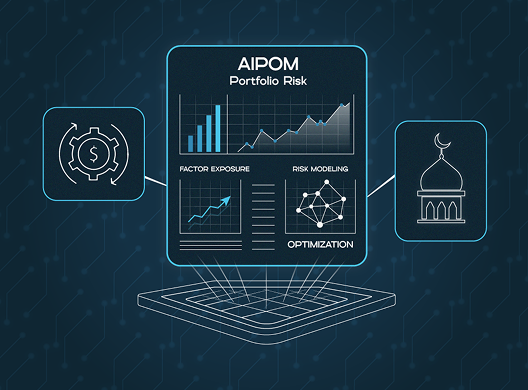

The AIPOM software provides a sophisticated portfolio risk modeling solution designed for both conventional and Islamic stocks.

Our models utilize factor exposure and operations research to deliver deep insights and support strategic decision-making.

Who we support

Family Offices

SGRs and Asset Managers

Custom portfolio logic for managing diversified or thematic strategies.

Fiduciary Firms

Enhanced portfolio monitoring aligned with regulatory or client-imposed investment guidelines.

Key Features

Multi-scenario stress testing

Portfolio rebalancing

Transparent, auditable model outputs for client reporting and governance

Hierarchical Allocation

of Trading Strategies

1-HAT is a logic-based system for optimizing and managing portfolios composed of multiple trading strategies.

It enables active strategy selection based on real-time performance analysis, allowing for smarter diversification and risk control without daily micromanagement

Who we support

Independent Asset Managers

Streamlined oversight of complex trading portfolios across discretionary, systematic, or hybrid strategies.

Multi-Family Offices

Tactical allocation and performance curation across diverse investment programs.

Quantitative Strategy Advisors

Rule-based execution logic adaptable to evolving market conditions.

Key Features

Auto activation and deactivation of strategies based on performance metrics

Dynamic allocation weights across active strategies

Scalable logic applicable across asset classes and strategy types

Operations Research (OR) originated during World War II, when military leaders sought scientific methods to improve logistics, resource allocation, and strategic planning. A team of scientists and mathematicians developed techniques to optimize the deployment of radar, manage supply chains, and schedule flights efficiently. This success led to the rapid adoption of OR techniques in both military and civilian operations after the war.

In the post-war era, industries such as manufacturing, transportation, and finance began utilizing OR to address problems like production scheduling, inventory management, and route optimization. The rise of computers and digital technologies in the 20th century further revolutionized OR, enabling complex models and large-scale simulations.

The Silent Engine of Success

Modern Business and OR

Today, Operations Research is a cornerstone of data-driven decision-making, combining disciplines such as mathematics, statistics, computer science, and engineering to solve problems across various sectors. Advanced techniques such as linear programming, simulation, decision analysis, and machine learning continue to expand the capabilities of OR, making it indispensable for modern businesses.

Our Value to clients

Family Offices

SGRs (Asset Managers)

Enhance traditional portfolio management with model-driven reallocation frameworks

Fiduciary Firms

Provide disciplined, transparent models that improve client oversight and regulatory compliance

Our Value to clients

Family Offices

Build durable, resilient portfolios adapted to unique family investment policies

SGRs (Asset Managers)

Enhance traditional portfolio management with model-driven reallocation frameworks

Fiduciary Firms

Enhance traditional portfolio management with model-driven reallocation frameworks

FAQ (Frequently Asked Questions)

We help clients bring structure and clarity to complex investment design. Below are

common questions we receive from family offices, SGRs, and fiduciary professionals.

What does OR SA Capital actually do?

We provide model-based tools and logic frameworks that help investment professionals design, test, and govern structured strategies — from portfolio allocation to rule-based index logic.

Is OR Capital SA a software company or a consultancy?

Our work combines operations research, financial structuring, and client-specific modeling. The result is a set of tools — like AIPOM or 1-HAT — that serve as a technical layer between your strategy and its implementation.

Can your products be integrated into existing systems?

Yes. We provide flexible delivery formats (e.g., dashboards, JSON logic, Excel connectors) depending on the client’s setup. Our models are often used alongside existing reporting or structuring platforms.

What types of firms typically work with OR Capital SA?

Family offices, fiduciary service providers, SGRs, independent asset managers, and financial advisors looking to enhance their strategy modeling, scenario testing, or documentation process.

Are your models compliant with regulatory standards?

Yes. Our modeling logic is designed with transparency and governance in mind. We help clients meet disclosure requirements (e.g., MiFID II, PRIIPs) by producing traceable, auditable logic for structured products or internal use.

Can we request custom scenarios or client-specific constraints?

Absolutely. Our tools are built to be modular and adaptable. Whether you’re looking to simulate inflation stress or alternative weighting logic, we can embed it into your product

or portfolio design.

Our people

Our team brings together financial analysts, software developers, legals, and market-facing product engineers.

Each of us contributes to turning model logic into live, compliant investment infrastructure.